Last week we wrote about the Tax Court’s application of Belk v. Commissioner, 140 T.C. 1 (2013) in the Bosque Canyon Ranch case. Here’s a more detailed description of the case.

Bosque Canyon Ranch (“BCR”) is a 3,729 acre-tract in Bosque County, Texas. Petitioners formed BCR I, a Texas limited partnership, in July 2003. BCR I made $2.2 million in improvements to BC Ranch between 2003 and 2005.

Bosque Canyon Ranch (“BCR”) is a 3,729 acre-tract in Bosque County, Texas. Petitioners formed BCR I, a Texas limited partnership, in July 2003. BCR I made $2.2 million in improvements to BC Ranch between 2003 and 2005.

In 2004, BCR I began marketing limited partnership interest (“LP units”) at $350,000 per unit. Each purchaser would become a limited partner in BCR I and the partnership would subsequently distribute a fee simple interest in a five-acre parcel of property (the “Homesite parcel”) to that limited partner. Each Homesite Parcel owner had the right to build a house on the parcel and use BC Ranch for various activities. The distribution of Homesite Parcels was conditioned on BCR I granting a conservation easement to the North American Land Trust (“NALT”) for 1,750 acres of BC Ranch.

BCR I granted the conservation easement to NALT on December 29, 2005. The land subject to the conservation easement could not be used for residential, commercial, institutional, industrial, or agricultural purposes. BCR I had 24 LP purchasers in 2005 with payments totaling $8,400,000. BCR I obtained a certified appraisal report effective November 28, 2005, valuing the conservation easement at $8,400,000.

BCR II was formed in December 2005 as a Texas limited partnership and BCR I deeded 1,866 acres of BC Ranch to BCR II. In 2006, BCR II began marketing Homesite parcels with offering documents were substantially similar to that of BCR I. BCR II granted NALT a conservation easement on September 14, 2007. BCR II collected payments of $9,957,500 from 23 purchasers and obtained an appraisal valuing the 2007 easement at $7,500,000.

After all of the transfers, the 47 limited partners of BCR I and BCR II owned approximately 235 acres and 3,482 of the remaining 3,509 acres were subject to the 2005 and 2007 NALT easements.

Procedural History

BCR I filed a 2005 Form 1065 reporting capital contributions of $8,400,000 and claiming an $8,400,000 charitable contribution deduction related to the 2005 NALT easement. The IRS sent petitioner a 2005 FPAA on December 29, 2008, determining that BCR I was not entitled to a charitable contribution deduction. The IRS also determined that petitioners were subject to either accuracy-related or gross valuation misstatement penalties. IRS counsel submitted an amended answer on April 26, 2010, contending that the BCR I transactions at issue were sales of real property.

BCR II filed a 2007 Form 1065 reporting capital contributions of $9,956,500 and claiming an $7,500,000 charitable contribution deduction related to the 2007 NALT easement. The IRS sent petitioner a 2007 FPAA on August 23, 2011, determining that BCR II was not entitled to a charitable contribution deduction and that petitioners were subject to either accuracy-related or gross valuation misstatement penalties. IRS counsel did not allege that the BCR II transactions were sales of real property. The Court consolidated petitioners’ cases for trial.

Charitable Contribution Deductions

The Homesite parcel owners and the NALT could, by mutual agreement, modify the Homesite boundaries. The deed forbids a decrease in “the overall property subject to the easement” and changes in the “exterior boundaries of the property subject to the easement.” The deed also provides that the boundary changes only occur between unburdened parcels (the Homesite lots).

The Court found that the property protected by the 2005 and 2007 easements could lose this protection as a result of boundary modifications allowed after the easements were granted. Citing Belk v. Commissioner, 140 T.C. 1 (2013), the Court held that the restrictions were not granted in perpetuity as required under IRC § 170(h)(2)(C) because the 2005 and 2007 deeds allow modifications between the Homesite parcels and the property subject to the easements. Thus, the easements are not qualified real property interests required under IRC § 170(h)(1)(A). (There are some distinct factual differences from Belk that we noted in an earlier post found here).

Judge Foley also took issue with the lack of documentation establishing the condition of the property provided by petitioners to NALT as required by Treas. Reg. § 1.170A-14(g)(5)(i). The Court found that the documentation was “unreliable, incomplete, and insufficient to establish the condition of the relevant property on the date the respective easements were granted.”

Disguised Sale

Judge Foley found that the partnerships deeded the Homesite properties to the limited partners within five months of the limited partners’ payments for the property. Under Treas. Reg. 1.707-3(c)(1) and 1.707-6(a) transfers between a partnership and a partner within a two-year period are presumed to be a sale of the property to the partner unless the facts and circumstances clearly establish that the transfers do not constitute a sale.

Petitioners argued that the partners’ payments would be at risk, pursuant to the terms of the LP agreements, if the easements were not granted. The Court rejected this argument based on its finding that the 2005 and 2007 easements were granted prior to the execution of the BCR I and BCR II LP agreements, respectively. Thus, the Court held that BCR I and BCR II were required to recognize income on any gains related to the 24 and 23 disguised sales by each limited partnership, respectively.

Gross Valuation Misstatement Penalties

Judge Foley held that the petitioners were liable for a 40% gross valuation misstatement penalty under IRC § 6662(h). Petitioner’s argued that they acted reasonably and in good faith by procuring a qualified appraisal from a qualified appraiser and by relying on a memorandum from their CPA. Judge Foley found that while these actions constituted a good faith investigation of the easement’s value, BCR I did not provide NALT with sufficient documentation of the condition of the property being donated and affirmed the 40% gross valuation misstatement penalty against BCR I for 2005.

For returns filed after August 17, 2006, the gross valuation misstatement penalty is modified by Treas. Reg. § 1.6662-5(g) when the determined value of the property is zero and the value claimed is greater than zero. Additionally, taxpayers who file returns after 2006 can no longer claim a reasonable cause defense for gross valuation misstatements relating to charitable contribution deductions. (Though reasonable cause is still a valid defense for substantial valuation misstatements. See, IRC § 6664(c)(3).) Thus, the Court held that BCR II is liable for the 40% gross valuation misstatement penalty relating to the 2007 tax year.

Read the full opinion here: Bosque Canyon Ranch L.P., v. Commissioner, TC-Memo. 2015-130

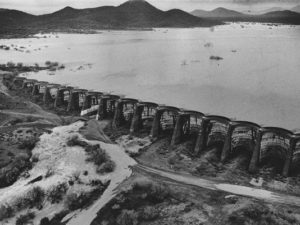

In a division opinion, the U.S. Tax Court reestablished the prospect of substantial compliance for taxpayers who claim charitable contribution deductions that require an appraisal. Three partners in a LLC sold property to Arizona’s Maricopa Flood Control District (you may have heard of Maricopa here) for less than fair market value. After obtaining two separate appraisals, the taxpayers claimed a charitable contribution on the difference between the lesser of the two valuations and the sale price.

In a division opinion, the U.S. Tax Court reestablished the prospect of substantial compliance for taxpayers who claim charitable contribution deductions that require an appraisal. Three partners in a LLC sold property to Arizona’s Maricopa Flood Control District (you may have heard of Maricopa here) for less than fair market value. After obtaining two separate appraisals, the taxpayers claimed a charitable contribution on the difference between the lesser of the two valuations and the sale price.