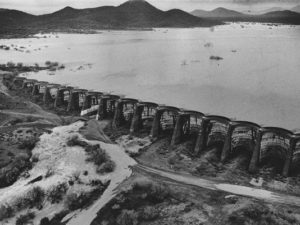

In a division opinion, the U.S. Tax Court reestablished the prospect of substantial compliance for taxpayers who claim charitable contribution deductions that require an appraisal. Three partners in a LLC sold property to Arizona’s Maricopa Flood Control District (you may have heard of Maricopa here) for less than fair market value. After obtaining two separate appraisals, the taxpayers claimed a charitable contribution on the difference between the lesser of the two valuations and the sale price.

In a division opinion, the U.S. Tax Court reestablished the prospect of substantial compliance for taxpayers who claim charitable contribution deductions that require an appraisal. Three partners in a LLC sold property to Arizona’s Maricopa Flood Control District (you may have heard of Maricopa here) for less than fair market value. After obtaining two separate appraisals, the taxpayers claimed a charitable contribution on the difference between the lesser of the two valuations and the sale price.

The IRS disallowed the deductions on the grounds that: the appraiser was not qualified; there was not a detailed description of the property; there was no statement that the appraisal was for income tax purposes; the valuation date was not the date of the contribution; and the appraisers’ definition of fair market value did not match that of the regulations. The IRS also argued that the value of the property was less than the sales price.

The government lost on every count. The court rejected the IRS’s nit pick approach to each of the appraisal documentation requirements – including the government’s argument that the Form 8283 did not include the signatures of both appraisers even though the form only has one signature line for an appraiser. The Court found that the difference of 11 to 21 days between the valuation date and the contribution date should not matter without “any significant event that would obviously affect the value of the property.” The Court also found that there are no magic words to fulfill the requirement that the appraisal state that it is for income tax purposes and the inclusion of the statement “for filing with the IRS” with the appraisal constituted substantial compliance with the regulation. With regard to each alleged violation of the charitable contribution regulations, the Court found that the taxpayers’ were in substantial compliance.

Finally, the Court rejected the valuation by the government’s expert which was based on “unreasonable assumptions” and adopted the appraisal presented by the taxpayers’ expert at trial (which was more than claimed on the original returns).

Read the opinion here: Cave Buttes, LLC v. Commissioner