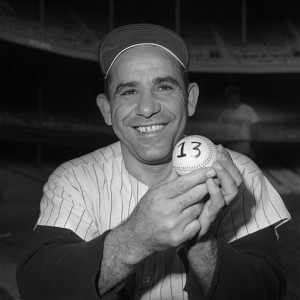

The IRS seems to have taken a nod from the legendary Yankee backstop, Yogi Berra, because “it’s déjà vu all over again.”

The IRS seems to have taken a nod from the legendary Yankee backstop, Yogi Berra, because “it’s déjà vu all over again.”

On January 9, 2012, the IRS announced that it was “reopening” the Offshore Voluntary Disclosure Program (OVDP) for an indefinite period. This is the latest incarnation of foreign bank account disclosure initiatives undertaken by the IRS. Prior programs included the 2003 Offshore Voluntary Compliance Initiative (OVCI), the 2009 Offshore Voluntary Disclosure Program (OVDP), and the recently closed 2011 Offshore Voluntary Disclosure Initiative (OVDI). The IRS seems to have adopted the name of the 2009 program, i.e., OVDP, for this current initiative.

The current program will track many of the requirements of the 2011 OVDI program but with some important, if still undefined, differences. First, the current OVDP will be open for an indefinite period. The IRS does note, however, that it may announce a closing date at any time in the future. There is no deadline for filing a disclosure under the current program but again the IRS notes that it could change the terms of the program at any time. The IRS announcement for the new program also specifically suggests that it may increase penalties for all or some taxpayers, or certain defined classes of taxpayers. The IRS promises additional guidance on the new program within the next month and another update to the frequently asked questions (FAQs) published under the 2011 OVDI program.

One known change from the 2011 OVDI program is that penalties for taxpayers in the highest penalty bracket will be increased to 27.5% under the new program. The disclosure penalty rates for volunteers holding fewer assets in foreign account will remain at 5% and 12.5%, at least for the time being. Volunteers still must file all original and amended tax returns and include payment for back-taxes and interest for up to eight years as well as paying accuracy-related and/or delinquency penalties. Volunteers who feel the penalty is disproportionate may still opt for an examination upon filing.

The current disclosure program, like its predecessors, is directed at U.S. taxpayers who hold interests in offshore or foreign bank accounts. U.S. taxpayers include U.S. citizens, dual citizens, permanent residents, and non-U.S. citizens who may be “substantially present” in the U.S. for tax purposes. The initiative tracks the annual requirement to file Foreign Bank Account Report (FBAR), Form TD F 90-22.1. The initiative covers any bank, securities, mutual fund or other financial instrument accounts held with a financial institution. It does not include individual bond holdings or stock certificates.

Finally, the press release notes the recognition by the IRS that dual citizens and others may be delinquent in meeting the FBAR filing requirements but still owe no U.S. tax. This long overdue recognition is accompanied by a promise that the IRS is developing procedures to allow these taxpayers to come into compliance with the law.