The U.S. District Court for the District of Idaho recently rejected the government’s pre-trial motion for summary judgment on the validity of a conservation easement donation, setting the stage for a trial on the facts of the transaction.

The U.S. District Court for the District of Idaho recently rejected the government’s pre-trial motion for summary judgment on the validity of a conservation easement donation, setting the stage for a trial on the facts of the transaction.

The District Court’s order and decision provides another ray of hope for Alan Pesky’s efforts to preserve his charitable contribution deduction for the conservation easement donation he made in 2002. Mr. Pesky has already been through a series of pre-trial motions. While this decision should have him headed for trial on the merits of the tax deductions for his donation, as we note below, the government has lobbed yet another missive over the transom.

The facts of the Pesky case are complicated but not necessarily unusual among high-net worth individuals with substantial real estate holdings who find themselves approached about a conservation easement donation. In stark summary, Alan Pesky was approached by The Nature Conservancy (TNC) to acquire a parcel over which a conservation easement ultimately was granted to TNC. The acquisition involved a series of negotiations and collateral agreements which may or may not prove to be relevant in sustaining the deduction.

When the donation was complete, Mr. Pesky deducted a portion of the conservation easement donation on his 2002 tax return and carried forward the remainder on his 2003 and 2004 returns. The government has challenged the charitable deductions for all three years but had to assert fraud for the 2002 tax year because it failed to issue a notice of deficiency within the three-year statute of limitations. The government made additional assertions of fraud which were addressed in this order (and elsewhere).

This case is a fine example of the Government’s recent approach to conservation easement litigation. The government wants to win early dismissal of these cases on pre-trials motions without allowing an examination of the facts and is willing to renew and recycle arguments that have failed before and been flat out rejected in other Federal circuits.

The government moved for summary judgment based on three primary arguments. The first argument was that the conservation easement was part of a larger quid pro quo transaction between the taxpayers and TNC. This argument has been considered in this context by the Tax Court in at least one reported decision but under substantially different facts than these. Considering the factors that might influence a jury on this question, the U.S. District Court ruled that a genuine issue of material fact remained for consideration at trial and denied the government’s motion.

The government’s second argument was that there was no contemporaneous written acknowledgement of goods and services received. Though the government conceded the existence of such an acknowledgment, its argument was an extension of the quid pro quo position, i.e., that there was no charitable intent. The court also rejected the argument based on the potential for a genuine issue of material fact. One might argue though that the taxpayer should prevail based on the substantial compliance doctrine adopted in Simmons v. Commissioner, T.C. Memo 2009-208 aff’d. 646 F.3d 6 (D.C. Cir. 2011).

Finally, the government argued that donation should fail because the Pesky’s property appraisal did not meet the standard for a qualified appraisal standard in the regulations. Again, the District Court leaned on potential for a genuine issue of material facts to deny the government’s motion. Given the minimum threshold standard for a qualified appraisal set forth by the Second Circuit Court of Appeals in Scheidelman v. Commissioner, 682 F.3d 189 (2d Cir. 2012), the taxpayers should also prevail on this issue.

In all events, the court rejected all three of the government’s arguments. The persistence of the government, however, should not be denied. Despite the court’s rejection of their positions just last Monday, the government had already filed a motion for reconsideration of the order on Friday requesting that the court take yet another look at these well-worn arguments. The Pesky’s might yet have their day in court, but not before they cross a few more hurdles the government intends to through in the way.

Read the Order Denying the Government’s Motion for Summary Judgement here:

Pesky Order 7.8.13

Read the Government’s Motion for Reconsideration here:

Pesky Motion for Reconsideration 7.12.13

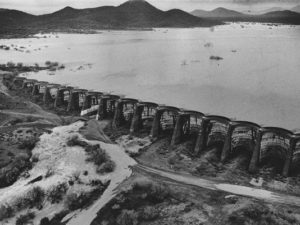

In a division opinion, the U.S. Tax Court reestablished the prospect of substantial compliance for taxpayers who claim charitable contribution deductions that require an appraisal. Three partners in a LLC sold property to Arizona’s Maricopa Flood Control District (you may have heard of Maricopa here) for less than fair market value. After obtaining two separate appraisals, the taxpayers claimed a charitable contribution on the difference between the lesser of the two valuations and the sale price.

In a division opinion, the U.S. Tax Court reestablished the prospect of substantial compliance for taxpayers who claim charitable contribution deductions that require an appraisal. Three partners in a LLC sold property to Arizona’s Maricopa Flood Control District (you may have heard of Maricopa here) for less than fair market value. After obtaining two separate appraisals, the taxpayers claimed a charitable contribution on the difference between the lesser of the two valuations and the sale price.